Blog

Discover how partnering with a software development agency can help maximise your R&D tax credits in the UK. Learn about upcoming legislative changes and tips for optimising your claim.

In the UK, the Research and Development (R&D) Tax Credit scheme is a valuable incentive for businesses innovating in science and technology. While many companies focus on their internal resources for R&D, leveraging a specialised software development agency can offer strategic advantages that maximise your claim. Here’s why partnering with an agency is often the smarter choice.

1. Expertise in Documenting R&D Activities

One of the most challenging aspects of claiming R&D tax credits is documenting qualifying activities. HMRC requires detailed technical narratives and precise cost breakdowns to validate your claim. A software development agency:

- Understands the R&D Criteria: Agencies often have experience in projects that inherently align with HMRC’s R&D guidelines, such as solving technological uncertainties or creating innovative software solutions.

- Provides Comprehensive Documentation: Agencies maintain meticulous records of time spent, technical challenges overcome, and methodologies employed, which can directly feed into your R&D claim.

This documentation not only ensures compliance but also reduces the risk of HMRC rejecting or questioning your claim.

2. Access to Specialised Skills and Resources

R&D often involves venturing into uncharted technical territory. A software development agency brings a diverse team of experts who specialise in cutting-edge technologies like artificial intelligence, blockchain, cloud computing, and more.

- Accelerated Innovation: Agencies have the infrastructure and expertise to quickly prototype, test, and iterate on ideas, ensuring faster progress on your R&D objectives.

- Cost Efficiency: Hiring and training in-house talent for a one-off R&D project can be costly and time-consuming. Agencies provide access to these skills on-demand, reducing overhead costs.

By outsourcing these efforts, you can maximise the technological challenges undertaken, directly enhancing your R&D tax credit claim.

3. Clearer Cost Segmentation

HMRC requires businesses to separate R&D-eligible expenses, such as employee salaries, materials, and software costs, from non-qualifying costs. This process can be intricate and time-consuming when handled internally.

A software development agency simplifies this by:

- Providing Transparent Billing: Agencies typically offer detailed invoices, categorising costs related to R&D activities.

- Streamlining Subcontractor Claims: If the agency is subcontracted, their costs can often be included in your R&D claim, subject to HMRC’s rules.

This clarity ensures that no eligible expenses are overlooked, maximising your claim.

4. Staying Up to Date with Legislative Changes

R&D tax relief legislation in the UK is constantly evolving, with significant changes being introduced in 2024. Staying informed and compliant with these updates can be a challenge for most businesses.

Software development agencies often have dedicated teams or partners specialising in R&D tax credits who:

- Monitor Regulatory Updates: Agencies stay ahead of the latest reforms, such as the new restrictions on overseas R&D and the merging of R&D schemes.

- Incorporate Changes into Processes: By aligning their operations with updated HMRC guidelines, agencies ensure that their clients’ claims remain compliant and optimised.

- Provide Strategic Advice: Agencies can guide businesses on how to adjust their R&D strategies to maximise benefits under the new rules.

This proactive approach ensures that your business is always leveraging the most up-to-date information and strategies.

5. Mitigating Risk and Uncertainty

Navigating the complexities of R&D tax credits can be daunting. Errors in your submission can lead to penalties, audits, or rejections. Agencies offer:

- Proven Processes: Agencies experienced in R&D projects understand how to align their workflows with HMRC’s criteria.

- Support During Audits: In the event of an HMRC inquiry, an agency can provide robust evidence and support to substantiate your claim.

By partnering with experts, you reduce the risk of non-compliance while ensuring that your claim is robust and defensible.

6. Focus on Your Core Business

Undertaking R&D while managing daily operations can stretch internal teams thin. By outsourcing to a software development agency, you can:

- Free Up Internal Resources: Allow your team to focus on core business objectives while the agency drives innovation.

- Benefit from Scalable Solutions: Agencies can scale resources up or down based on project requirements, giving you flexibility.

This collaboration ensures that your business remains agile and competitive without compromising on R&D ambitions.

7. How to Estimate Your Potential R&D Claim

If you’re wondering how much you might be able to claim, it’s wise to consult an experienced R&D tax credit advisor. Specialists like Walmer Group can help you assess your eligibility, estimate your claim amount, and guide you through the submission process. Working with an advisor ensures that your claim is maximised while remaining compliant with HMRC’s requirements.

Conclusion: A Strategic Advantage

Maximising R&D tax credits isn’t just about claiming back costs; it’s about leveraging those funds to drive further innovation and growth. A software development agency provides the expertise, resources, and transparency needed to optimise your claim while delivering cutting-edge solutions.

By partnering with a software development agency, you not only streamline the R&D process but also position your business for long-term success. It’s not just an investment in software—it’s an investment in your company’s future.

Looking for a partner to amplify your R&D efforts? At Blott Studio, we specialise in innovative software solutions that align with your business goals and help you maximise your R&D tax credits. Contact us today to explore how we can bring your ideas to life.

Learn the basics of cybersecurity and why they are critical in today's digital age. Explore how mastering the fundamentals supports compliance with DORA and strengthens your organisation's resilience against cyber threats.

As the digital world evolves, so do its challenges. Cybersecurity is no longer a mere technical consideration; it’s a strategic imperative for businesses. The introduction of frameworks like the Digital Operational Resilience Act (DORA) by the European Union has further emphasised the importance of building a strong cybersecurity foundation.

For individuals and organisations alike, especially those in sectors like fintech, securing digital ecosystems is essential to maintaining trust, protecting sensitive data, and ensuring compliance. This guide explores the basics of cybersecurity and why getting them right is more critical than ever.

What is DORA, and Why Does It Matter?

The Digital Operational Resilience Act (DORA) is a regulatory framework introduced by the EU to strengthen the operational resilience of financial entities. It requires firms to ensure they can withstand, respond to, and recover from cyberattacks and operational disruptions.

Key Pillars of DORA:

- Risk Management: Identifying and managing ICT (Information and Communication Technology) risks.

- Incident Reporting: Streamlining processes for reporting cyber incidents.

- Resilience Testing: Regularly testing systems to withstand cyber threats.

- Third-Party Oversight: Managing risks from outsourcing and ICT service providers.

- Information Sharing: Promoting the exchange of cybersecurity intelligence.

For fintech companies and related service providers, DORA underscores the importance of robust cybersecurity practices. Without the basics in place, complying with DORA's requirements becomes almost impossible.

The Basics of Cybersecurity: A Prerequisite for Resilience

Getting the basics right forms the foundation of digital operational resilience. Strong cybersecurity hygiene reduces vulnerabilities and lays the groundwork for more advanced resilience strategies.

Why the Basics Matter More Than Ever

The basics of cybersecurity, like password management and regular updates, might seem straightforward, but they are often neglected. According to studies, over 80% of breaches result from easily preventable issues, such as weak passwords or unpatched software. With DORA, these oversights can have regulatory consequences.

How the Basics Support DORA Compliance:

- Strong Password Policies and MFA: Essential for protecting access to sensitive systems, reducing the likelihood of breaches.

- Regular Software Updates: Prevent exploits targeting outdated systems, ensuring resilience against common vulnerabilities.

- Data Backups: Critical for quick recovery in the event of a ransomware attack or data corruption.

- Incident Awareness: Training staff to identify phishing attacks can significantly reduce the chances of incidents requiring DORA-mandated reporting.

- Network Security: A secure, encrypted network ensures that operational disruptions are minimised, supporting resilience.

Practical Steps to Strengthen Cybersecurity Basics

Here’s how organisations can align their cybersecurity practices with DORA’s requirements by focusing on the essentials:

1. Establish Strong Identity Controls

- Enforce multi-factor authentication (MFA) across all systems.

- Regularly audit access privileges to ensure only authorised personnel can access sensitive data.

2. Regular Updates and Patching

- Create a schedule for applying software and firmware updates.

- Use automated tools to identify and patch vulnerabilities in critical systems.

3. Build a Resilient Backup System

- Follow the 3-2-1 rule: Maintain three copies of data on two different media types, with one stored offsite.

- Test backups regularly to ensure they can be restored quickly in emergencies.

4. Train Employees Continuously

- Conduct regular cybersecurity training tailored to roles and responsibilities.

- Emphasise the importance of vigilance in spotting phishing attempts and other common threats.

5. Secure Your Supply Chain

- Vet third-party providers for adherence to security standards.

- Incorporate cybersecurity requirements into contracts with ICT vendors, aligning with DORA’s oversight provisions.

DORA: Raising the Stakes for Cybersecurity

Under DORA, failure to implement even basic cybersecurity measures could lead to:

- Operational Downtime: Unaddressed vulnerabilities can lead to disruptions, directly impacting business continuity.

- Regulatory Sanctions: Non-compliance with DORA can result in fines and reputational damage.

- Loss of Trust: Customers and stakeholders demand assurance that their data is safe and accessible.

The message is clear: if the basics aren’t done right, advanced resilience efforts, no matter how sophisticated, will crumble under pressure.

Looking Ahead: Cybersecurity as a Continuous Journey

Cybersecurity basics aren’t a one-time task—they are ongoing commitments. Frameworks like DORA aim to create a culture of continuous improvement and operational resilience, but that starts with mastering the fundamentals.

By focusing on strong passwords, regular updates, secure networks, and robust training, businesses can not only comply with regulations like DORA but also build trust with clients and partners.

At Blott Studio, we understand the importance of cybersecurity in the design and development of resilient digital solutions. If you’re looking to enhance your operational resilience or navigate frameworks like DORA, get in touch with our team today. Let’s build a future where innovation and security go hand in hand.

Discover the ultimate guide to fintech security. Explore key strategies to protect data, prevent fraud, and comply with regulations, ranked in order of importance to help your fintech thrive securely.

In the rapidly evolving fintech industry, where trust is the currency of success, security must be prioritised above all else. Handling sensitive financial data and facilitating transactions comes with significant responsibility, and fintech companies must establish strong safeguards to protect their users and operations.

Below, we outline the most important security considerations for fintechs, ranked in order of priority, to help ensure success in this high-stakes industry.

1. Regulatory Compliance: A Non-Negotiable Foundation

Fintechs must adhere to a complex framework of regulations. Compliance is essential not only to avoid penalties but also to build trust with customers. Laws such as GDPR, PCI DSS, and FCA regulations form the backbone of a secure and compliant fintech operation.

How to prioritise compliance:

- Conduct regular audits to ensure ongoing adherence to regulations.

- Stay updated on changes to industry laws, such as PSD2.

- Partner with compliance experts to navigate legal complexities.

2. Data Protection: Safeguarding Sensitive Information

Data breaches can have catastrophic consequences. Fintechs must secure all customer data at every stage, from storage to transit. By employing encryption, tokenisation, and data masking, sensitive information can be kept out of the wrong hands.

Best practices for data security:

- Use advanced encryption methods like AES-256.

- Replace sensitive data with tokens whenever possible.

- Mask customer data in logs, non-production environments, and UIs.

3. Identity and Access Management: Securing Access Points

Compromised credentials are one of the leading causes of breaches. A strong identity and access management (IAM) strategy ensures that only authorised users and systems can access sensitive data.

How to secure access:

- Implement multi-factor authentication (MFA) for all logins.

- Use role-based access controls to limit permissions.

- Adopt zero-trust principles, verifying all access requests.

4. Fraud Prevention: Staying Ahead of Threats

Fraud is a constant challenge for fintechs. With the help of artificial intelligence (AI) and real-time monitoring systems, companies can detect and prevent fraudulent activity before it escalates.

Steps to prevent fraud:

- Leverage AI to identify unusual patterns in transactions.

- Set up real-time alerts to flag suspicious activities.

- Strengthen user authentication with biometrics and behavioural analytics.

5. Secure Development Practices: Building Security from Day One

Security must be embedded in the development lifecycle. Following secure coding principles and addressing vulnerabilities early can significantly reduce risks.

Key development practices:

- Perform code reviews regularly to catch potential flaws.

- Use automated tools for static and dynamic code analysis.

- Follow the OWASP Top 10 recommendations to mitigate common threats.

6. API Security: Protecting the Digital Ecosystem

APIs form the backbone of fintech services. However, insecure APIs can expose sensitive data and open the door to cyberattacks. Fintechs must ensure all APIs are secure and resilient.

How to secure APIs:

- Authenticate API calls using OAuth 2.0 or JWT.

- Validate all inputs to prevent injection attacks.

- Implement rate limiting to control API usage and deter abuse.

7. Infrastructure Security: Fortifying the Foundation

Behind every fintech service is an infrastructure that needs to be safeguarded. Networks, servers, and cloud platforms must be hardened against external and internal threats.

Steps to protect infrastructure:

- Deploy firewalls and intrusion detection systems.

- Leverage cloud-native security tools from providers like AWS or Azure.

- Regularly test disaster recovery plans to ensure business continuity.

8. Third-Party Risk Management: Minimising External Vulnerabilities

Most fintechs rely on third-party vendors, which can introduce security risks. Proper due diligence and ongoing monitoring of these vendors can reduce exposure to vulnerabilities.

How to manage third-party risks:

- Evaluate vendors for compliance with industry standards.

- Clearly define data-sharing agreements.

- Regularly audit third-party systems and processes.

9. Incident Response: Planning for the Unexpected

Even the best defences can be breached. A robust incident response plan ensures fintechs can quickly recover and mitigate the impact of any security incidents.

Building an incident response plan:

- Develop a detailed, actionable plan for handling breaches.

- Monitor systems 24/7 for suspicious activities.

- Conduct post-incident reviews to identify lessons learned.

10. User Education: Strengthening the Human Firewall

Many security breaches occur due to human error. Educating users and employees about best practices can significantly reduce risks.

What to focus on:

- Teach users to identify phishing attempts and scams.

- Encourage strong passwords and secure account management.

- Design intuitive, user-friendly security features to reduce mistakes.

11. Penetration Testing: Identifying Weak Spots

Regular penetration testing helps uncover vulnerabilities before malicious actors can exploit them. Ethical hackers and security auditors can test fintech systems for weaknesses.

How to implement penetration testing:

- Schedule annual penetration tests with independent security experts.

- Launch a bug bounty programme to encourage vulnerability reporting.

- Use findings from tests to continually improve systems.

12. Privacy by Design: Building Trust Through Transparency

Privacy must be built into every system. This approach not only ensures compliance but also fosters user trust and loyalty.

How to prioritise privacy:

- Collect only the data you absolutely need for operations.

- Anonymise data wherever possible to protect user identities.

- Provide clear, accessible options for users to manage their privacy settings.

13. Emerging Threats: Preparing for Tomorrow’s Challenges

The threat landscape is constantly evolving. Fintechs must stay ahead by anticipating new risks, such as quantum computing and AI-driven attacks.

How to prepare:

- Begin transitioning to quantum-safe cryptography.

- Stay informed about AI tools used for cyberattacks.

- Train teams to recognise and respond to advanced social engineering attempts.

Conclusion

Security in fintech is not a destination but an ongoing journey. By addressing these considerations in order of importance, fintech companies can create secure systems that inspire trust and support long-term growth. In an industry where trust is everything, a robust security strategy isn’t just an advantage—it’s a necessity.

What’s that? Some call it the “eureka” moment. Some, the “wow” moment. But it’s all in the name; the “aha” moment is when a user thinks, “Aha! I get it.”

What’s that? Some call it the “eureka” moment. Some, the “wow” moment. But it’s all in the name; the “aha” moment is when a user thinks, “Aha! I get it.”

If you read my last blog post, you’ll know that first impressions matter. The first-time user experience is really important in long-term engagement. Why? Because users are exploring. They’re curious. And they probably have a problem to solve. With Saas competition on the rise, users might not stick around if they don’t find value quickly. So the sooner they feel that “aha,” the better.

Plus, a good first impression will keep your users coming back for more. Stats show that improvements in the first 5 minutes can drive a 50% increase in lifetime value.

How do we find it?

Your job is to find out which actions or behaviours led users to their “aha” moment. Then, adjust your product accordingly so that more users take that same path.

Step 1: Look For Patterns

Whether you have your own platform or use third-party tools, turn to your user data analytics. You want to look closely at what separates your “power users” from your visitors. Did they finish your onboarding experience? Did they continue using your app after the product tour? Did they engage with any of the core features? This will help you understand your product’s retention trends. Focus on those who stayed instead of those who didn’t.

For example, the behaviour exhibited by the most number of retained users is meaningless if it’s the same behaviour exhibited by the most number of churned users. But the behaviour exhibited by the most number of retained users, and only a few churned users? That’s something to look into.

Step 2: Ask Your Users

You’ve got your quantitative data. Now it’s time for qualitative data. Reach out to those “power users” for feedback. They know the ins and outs of your product. If the numbers have shown a correlation between certain behaviours and retention, these users can tell you why.

There’s no wrong way to get in touch. A survey, email or phone call will do. You’ll get information that the numbers can’t give. Why? Because people speak. They’re expressive. You’ll find out what features they used first, what other options they considered, and at what point your product became their go-to.

Don’t discount your churned users. You can learn from them too. If they didn’t find your product useful, you’d benefit from knowing why. Maybe they experienced some friction in the user experience. Maybe they prefer another platform (blasphemy!) So, ask them. Well, try. Chances are one-time users won’t be as giving as your loyal customers with their time, but a quick exit survey could do the trick.

For example… Asking a multiple choice and an open-ended question is a quick and easy way to get actionable feedback from churned customers.

Step 3: Experiment With New Users

You’ve identified patterns and you’ve listened to users. By now, you’ve got some idea what influences retention. This is called your hypotheses, and you’re going to test it. How? With new users.

You’ll reverse-engineer the journey of your “power users” and apply it to segmented newcomers. Yes, segmented. You need a “control group” who aren’t exposed to the changes. Use A/B testing to determine how variables impact retention.

If your hypothesis is proved? Great. You know where to drive your users. Once they get there, they’ll experience value and they’ll stay. So you’ve got a clear goal for your onboarding.

The goal?

There are many “aha” moments. And there are many factors that contribute to them. As your user-base grows, so will your understanding of what these factors are.

The best product leaders think about value from their user’s perspective. Make it easy for your users to find the value in your product. It isn’t always obvious. Experimentation, iteration and analysis is key to a better experience. For you, and your customers.

And remember, your users are the reason for your product. They have a problem. You have a solution. Make sure it solves their problem better than anybody else.

As much as we’d love to think that our users are a lot like us, they rarely are. That’s why it’s important that we understand who they are, what they need, and how they go about getting it. Our products are designed for them.

As much as we’d love to think that our users are a lot like us, they rarely are. That’s why it’s important that we understand who they are, what they need, and how they go about getting it. Our products are designed for them. So why not improve the experience?

User testing is a great way to do this. Gathering unbiased opinions will ultimately lead to a better user experience. Ask the right questions and you’ll get the right insights, ones that you can act on.

First things first…

You need to define your objectives. Figure out what it is you want to achieve, and why. Are you looking to prove a hypothesis? Find issues in your product? Understand how people interact with your competitors? A clear objective will help you create the right questions and get to where you need to be.

Essentially, your questions should produce a mix of qualitative and quantitative data. Think multiple choice, open-ended and the yes/no type. Throw in a practical exercise, and you’ve got yourself a recipe for success.

Screening Questions

Right. You know what you want. Now you’ve got to decide who to get it from. Who would be your ideal candidate; someone who’s just signed up? Or a power user? Get your demographic and experience questions out the way. They’ll help you find potential participants. Plus, you can use this information at a later stage in your analysis of the final results.

1. How old are you?

2. What’s your highest level of education?

3. How much time do you spend online?

4. What apps and websites do you use on a regular basis?

5. What’s your income level?

Pre-test Questions

Once you’ve selected your test subjects, you’ve got another opportunity to filter them. This will uncover whether or not participants know enough about your products to provide relevant feedback. Do this through a questionnaire, survey, face-to-face interview or any other way that works for you. Plus, knowing the backgrounds of your participants means you’ve got context for the way they interact with your product.

6. What made you choose this website/app?

7. How often do you use the website/app?

8. Which features do you use most?

9. What other websites/apps did you consider using?

Test Questions

It’s time for the real deal - the test. During this stage of questions, your goal is to collect data that explains why users make certain choices while interacting with your product. It could be silent, with users completing tasks and then answering questions after. Or, it could be conversational, with users talking through their thought process at each step.

Our advice? Make it conversational. The more relaxed participants are, the more open they’ll be.

10. I noticed you did ___. Can you tell me why?

11. Is there another way to do that?

12. What stops you from completing a task?

13. How do you use the X feature?

14. What do you think of the interface?

15. What do you think of the design?

16. How do you feel about the way information is laid out?

17. What do you think of X page? How easy is it to find?

Post-test Questions

Missed anything? Not fully understanding certain answers? Now’s your chance. It’s also a great time to let your participants ask a few questions or offer feedback they believe is relevant. These questions can be more general to get an overall opinion on the user experience.

18. What’s your overall impression of X?

19. What’s the best and worst thing about X?

20. How would you change it?

21. How would you compare X to a competitor?

Note taking?

Forget about it. You won’t be able to focus on non-verbal cues if you’re furiously scribbling down minutes. It might also distract your participants or make them even more uncomfortable than they already are. Record your interview instead. Then, upload it to a transcription service. Like the speech-to-text software, Rev.

Constructive criticism?

It’s one of the necessary evils, especially in tech. The more usability tests you run, the more feedback you’ll get - good and bad. But that’s okay. Without different perspectives, you wouldn’t be able to see the bigger picture and then better your product. Plus, allowing your users to rip your work to shreds in the name of improvement often results in an even better user experience than anyone could have imagined.

Startups fail from time to time. Not because of a lack of good ideas, but because the wrong idea’s been chosen.

How to prioritize product features and improvements

Startups fail from time to time. Not because of a lack of good ideas, but because the wrong idea’s been chosen. Most product managers will agree that the hardest part is deciding which features deserve the team’s blood, sweat, and tears. Okay, we lied. There’s no blood.

.avif)

First things first.

Goal setting is a serious problem. Before you can even think about prioritising your features, you have to figure out what it is you’re working towards. Think, “shared vision.” Without it, you’ll go round in circles.

As Max McKeown, author of “The Innovation Book: How to Manage Ideas and Execution for Outstanding Results” writes:

“Strategy is not a solo sport, even if you’re the CEO.”

Prioritization? It’s not personal.

But… It can be. Humans are complex creatures. They have emotions, opinions and ideas. And when those ideas are shared with the team, they have to be acknowledged. Why? Because every idea is a reflection of someone’s hard work and experience. Fair enough. But it does make things complicated.

It’s important to remember that you’re not picking someone’s idea over someone else’s idea. You’re picking what’s right for the company. So, prioritization? It’s not personal. Fact.

Hippos and out-of-nowhere requests.

A bit confused? So is your team. The Highest Paid Person’s Opinion (HiPPO) has the power to veto certain ideas or insert personal choices without the necessary backing. Why? Because they’re usually in a senior position, so they’ve probably got good judgement.

This can be frustrating for the team though. Nobody likes it when high-level ideas are added to the list as “must-haves.” Decisions made or changed without evidence have the potential to derail even the most thought-out plans and leave team members feeling lost. Most leaders don’t want that. So, no evidence? No action.

What’s the opposite of subjective?

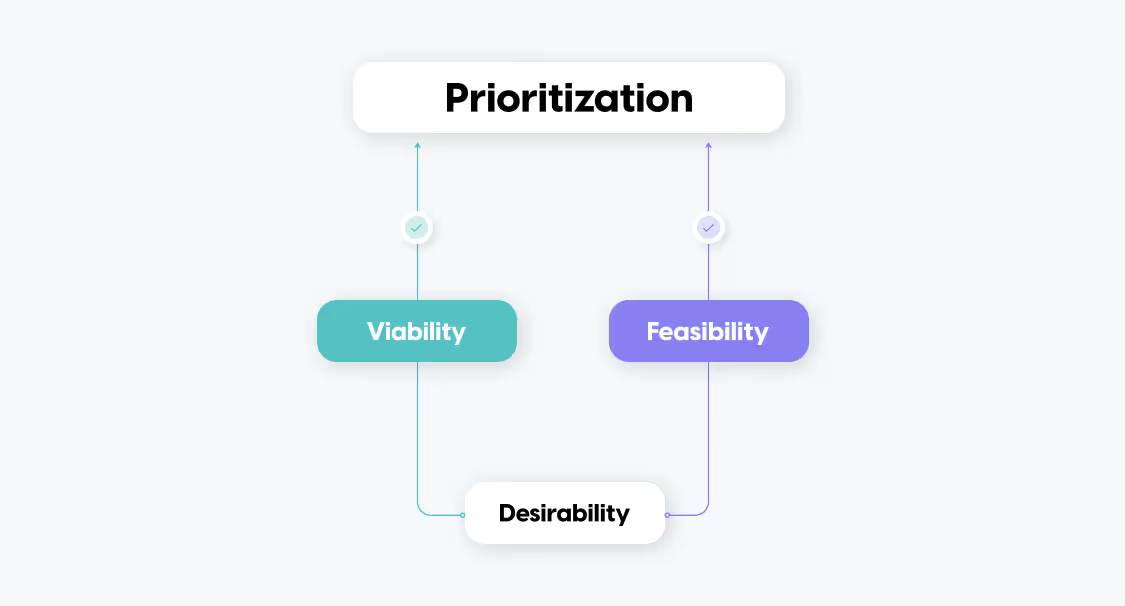

Objective. Correct. If personal bias can lead the team down the wrong road, then look at features through an impartial lens. Breaking them up into categories of criteria is a good way to do this.

- Feasibility. Can you do it? And by “you,” we actually mean the technical team. Speak to your front-end, back-end and UI designers to understand what can and can’t be done.

- Desirability. Do your customers need it? If you’re solving a pain point, then yes. That’s great. But if you’re not, then you’ll have to rethink your solution.

- Viability. Is your solution capable of succeeding long term? It needs to serve a bigger ecosystem. Will it keep up with the industrial times? Does it support your overall strategy? Hard to test, but worth it.

If you hear the word “gut instinct,” abort mission. This, along with customer requests and isolated economics are not ways to prioritise your strategic goals and activities.

Constraints are the new filters.

Time constraints. Money restrictions. Lack of expertise. They’re all important. If you don’t have the time, resources or skills for the job, you can’t get it done. Simple.

Constraints come down to two factors; people and processes. If you have the right people with the right skills to get the job done, then figure out which of those people will provide the best results. Someone who works well under pressure is better suited for time sensitive work. Are they more valuable than their peers? No. Not at all. The idea is to align certain personalities and working styles with certain outcomes.

And if you don’t have the right people with the right skills, outsource. Or hire. Conflicted? We touched on the topic in this article.

As for processes? Some teams use a home-grown approach, others a standard process. But a mix of the two is most common. The best processes are those that keep the team focused while allowing for the flexibility of everyday life.

Our advice?

Keep it real. There’s always a lot of hype around new features. They’re exciting! As a product manager, you need to be the voice of reason. Sorry.

Build a roadmap and add your priorities into it. This will keep the team on the same page and help you track your progress. Plus, we’re visual beings. We want to see what we’re working towards and how we’re going to get there. If you make data driven decisions, set aside time for regular check-ins and keep your roadmap front-of-mind, you’re in for a smooth ride.

Why are people using one feature three times more than another? Why are they falling off the wagon on the last step? Why are customers using your product less frequently than before?

Why are people using one feature three times more than another? Why are they falling off the wagon on the last step? Why are customers using your product less frequently than before?

Don’t you wish you could just… Ask them? Well, you can.

That’s what product feedback is all about.

Company lacking feedback?

You’re wrong.

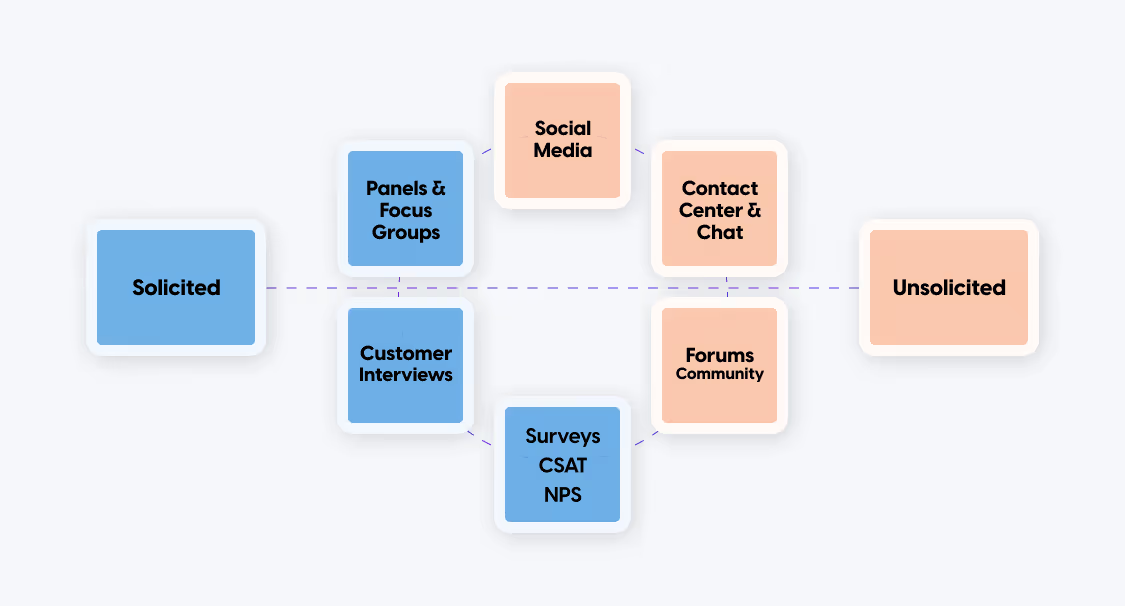

It’s in your reviews, your support queries, your community forums... You just have to look for it. This is considered unsolicited feedback. It’s typically text-based and requires some effort to organise. It’s worth it though. And much like unsolicited advice, we don’t always like it. But in business, nothing is personal. Right?

There’s also solicited feedback. This means you ask your customers for it. How? You could send out a survey or hold interviews. You could host panel discussions and support groups. Or, you could even just have a rating option. There are many ways.

In this scenario, less is not more. You want to include both types of feedback from a variety of channels. This will help you get a well-rounded understanding of how your product is interpreted by users. Balance.

Feedback: Check. Now what?

Now, give it meaning. Few companies actually take action. Be one of them. By closing the loop, your customers know that they’ve been heard. Plus, you’ll set yourself apart from your competitors. Why? Because you’ve made it clear that you care.

Gather your feedback, turn it into insights, and send it off to your product team. They’re responsible for product decisions, right? So make sure your insights reach them. Get more feedback (and brownie points) by showing your users your new and improved product.

Need help with your feedback strategy? Here are 3 questions to ask yourself:

- Who needs to be involved in gathering feedback, and what role will they play?

- Think of churn, growth and other data. Which sets will you use to make decisions?

- What’s the best way to update your team about your progress, and your users about your improvements?

Analyze.

Easy? Nope. There are a lot of challenges when analyzing feedback. Seriously. If done manually, it can take a helluva long time. Also, each bit of feedback rarely fits into one category, if ever. Why? Because humans love to mention a bunch of different themes in their reports. Plus, visualizing this data is tricky.

Do we have advice? Of course.

Group your feedback into quantitative data.

Yes, even if it’s qualitative. If one user can’t find the checkout and another user can’t find the product, tag them both with an “improve search.” Take care not to overlap with your teammates though, a slight difference in linguistics could cause an unnecessary delay. And we don’t want that. So, no “poor search” and “improve search” tags. Pick one.

All feedback was (not) created equal.

What this means? You’ve got to link your feedback to demographic and behavioural customer data. Is this a new or old customer? How often do they use your product? How did you acquire them? Consider all aspects of who your customers are.

Who cares about feedback?

Honestly? Everyone. Feedback is a two-way street. You get feedback, then you return it... In the form of an update. It’s really valuable. Just as valuable as data. Why? Because it’s a form of data. When feedback is gathered, analyzed and actioned correctly, it works in the exact same way as data. True story. Testing hypotheses, discovering insights and aligning teams becomes easier with feedback. Sound familiar?

Give the people what they want.

You’ve got access to so much information about your users. Seriously. So there’s no excuse for not knowing what they like and dislike. It’s at your virtual fingertips. Take advantage of the data available and do something with it. Building a great product and marketing it well is only half the job. The other half? Committing to a customer-centric culture. Without your users, your company would be pointless. Be sure to find, analyze, share and implement feedback across your brand. Internal communication is key during your feedback journey, which should be a consistent and ongoing one.

Fun fact? Your support team always understands more about your customers’ needs than your product team. Always.

Brainstorming session, discovery group, team meeting; whatever. Every project should start with a group discussion- client included.

Brainstorming session, discovery group, team meeting; whatever. Every project should start with a group discussion- client included. Why? Because it’s important for your team to have an accurate idea of your client’s business, its goals, and a whole lot of other (related) insights that help with execution.

Usually, a discovery session takes place after a contract is signed, but it’s not uncommon for it to occur beforehand. That’s because not all services that software developers offer are suitable for those who enquire about them, and there’s no time to waste in the Saas world. Back and forth emails? Nope. No thank you.

The point?

From identifying bottlenecks to creating a project roadmap, there are many outcomes of a successful discovery session. You can’t put a price tag on a project if you don’t know what services you’ll be exercising, so evaluating the state of your prospective client’s product is key.

Do this beforehand- it’s homework. Check out their company profile as well as every page of their website and app. Look at their services, competitors and ratings. Don’t forget to take note of your own first impressions, too. Looks promising? Great. Set a time.

Who’s involved?

If you’ve got a big and busy team, you probably don’t want to halt the progress on every project to meet with a maybe-client. Instead, have representatives from each department join the discussion. Your developer, UX designer, and project manager is important, but so is your strategist and facilitator.

Let the teammate with the highest level of understanding about your client’s business run the meeting. Why? Because they’ll encourage a deeper conversation. It’s generally a good idea to have this person translate the information into a strategic outline too- like a project plan.

The questions?

Need better answers? Easy. Ask better questions. Your clients may not know exactly what they want, so ask questions. A lot of them. Focusing on the questions, not the answers, will help with breakthrough insights and ultimately better align the both of you.

Start with constraint-related questions.

- Cost. What’s the budget?

- Scope. What’s the outcome? (New processes? Software? An upgrade?)

- Time. What’s the deadline?

Find out who the key stakeholders are.

- Sponsor. Who (or what) is providing support and resources?

- Customers. Who are the people who will pay for this?

- End-users. This one’s a no-brainer. Who’s going to use the product?

Set your intentions.

- Sprint duration. How long will you spend on each sprint?

- Tools. What software are you going to use to help you?

- Communication. How are you going to reach each other?

The interviews?

You’ve done your homework. Your maybe-client is now a yes-client. And you’re ready to talk business. So, chat (remotely) to the specialists on your client’s side. Why remotely? Because it’s easier, and you’ll have a far greater reach. If the specialists are too busy, an online form is a great compromise. This way, the specialists give you information in their own time. And you can focus on your other projects in the meanwhile. Win-win, right?

Need insights from the other side? Of course you do. Reach out to the end-users. How? With questionnaires or surveys. Don’t have end-users yet? Steal the target audience from your competitor. Go on, we won’t tell. Find out what the pain points are. A healthy combination of qualitative and quantitative is important, so A/B tests probably aren't the best way to go about this one.

Got your answers?

Great. Structure all of them, and move on to the following:

- What are the user’s pain points? Is there more than 1 type of user?

- Prioritize every issue. You can use the Decision Matrix to do this. It’s built on axes; “urgent” to “not urgent” and “important” to “not important.” The space with “urgent” and “important” gets first priority.

- Brainstorm a solution to every problem or opportunity. Your software developers should be involved in this one.

- Create a MVP. This is a low-fidelity prototype for a quick and easy representation of your product. Use it to improve the next version by getting quick feedback.

- Compare how the current product works versus how the future product will work.

- Create a roadmap.

What does this achieve? Your client gets a glimpse of the future product. And once you’ve got the go-ahead, you can start working towards it.

Our tips?

Communicate via Slack. It’s great for business-related instant messaging. Plus, it’s faster, better organised and more secure than email.

Delegate tasks with Trello. You can also manage, track and share your progress with your team.

Transcribe meetings with Otter. You get 600 minutes free per month, and it’s pretty accurate.

Record your meetings with QuickTime- video or audio.

The dictionary (well, Google) describes the term “Agile” as “able to move quickly and easily.” That’s true, even in the context of tech. But it’s also more than that.

The dictionary (well, Google) describes the term “Agile” as “able to move quickly and easily.” That’s true, even in the context of tech. But it’s also more than that. In the world of a software developer, “Agile” refers to a project management approach, and it’s a pretty common one.

The idea behind “Agile” development is that you build a framework nimble enough (agile enough) to adjust to changing demands. It’s probably one of the simplest yet most effective ways to turn a vision into something real. Plus, it’s quick. And there’s less risk. Instead of spending precious time and valuable money in the development phase of a product you have yet to find a market for, it gets broken up into the smallest, most basic version of your idea- the “minimum viable product.”

.avif)

This flexi-methodology emerged as a solution to the shortcomings of waterfall- a different (more expensive) way of finding a product-market fit. There’s only so many times you can afford to scrap and rebuild your product, and the time it takes to go through another product iteration in waterfall puts you at a disadvantage. Competition is rife in the Saas side of town.

It’s a continuous process, but don’t be fooled- Agile is anything but boring. The iterations are done in sprints, typically 4-6 weeks with a presentation to the client at the end. Then, repeat. Doing it this way replaces high-level design with frequent redesign. Plus, it allows you to test the application in real time, learn from your mistakes, and adjust the development strategy accordingly.

.avif)

The pros?

- There’s transparency between all parties, and at all points- users and clients included. Why? Because of the ongoing iterations. This makes having a shared vision easy, even in the face of unforeseen changes.

- Quality? Check. Breaking your project up into iterations means you’re able to focus on specifics. And because you’re constantly testing and iterating, your product gets updated and upgraded all the time.

- Early release. Remember that “minimum viable product?” It goes to market before the final product is ready. So identifying your product’s weaknesses and strengths becomes easy, and correcting them? Even easier.

- Costs are predictable. Because of the fixed sprints, the project can be well budgeted for. That’s the dream, right? And, because of the sprints, the project can also be frozen if necessary- something that’s not possible with waterfall.

- Changes can be made, and made often. Because your product is constantly evolving, you have ample opportunity to tweak things.

The cons?

- When do you stop improving your product? With Agile development, you don’t. Okay, you do. But it’s hard to. The desire to make endless changes can lead to a deadlock.

- Working in short-term iterations can hamper your long-term progress. And since it’s hard to tell what the end product is going to look like, it becomes difficult to predict the time, cost and effort it’s going to take to get there.

- Hard to maintain. Why? Because the level of collaboration is pretty high.

Even though the pros outweigh the cons, Agile isn’t for everyone. And if it isn’t for you, no worries. There are loads of different alternatives. Like waterfall, scrum or DevOps.

Waterfall

The Waterfall model is the earliest approach ever used in software development. And honestly? It makes sense. It’s the most logical. Seriously, the name is even sensible- progress flows towards the end goal, like a waterfall. So if you’re someone who likes structure, order and tick boxes, this traditional methodology’s for you.

Scrum

Not a fan of Waterfall? Take a look at Scrum. It’s similar to Agile in terms of the sprints and MVPs, but it’s not the same. Everyday you attend a brief meeting chaired by the “Scrum Master.” Fun, right? This is essentially to touch-base with your team. There’s also a product backlog, so a complete list of functionality yet to be added to the product. The best way to create a product backlog? Populate it with short descriptions from the perspective of your users. It helps if you do this on the first day of your sprints.

DevOps

Option 3? Merge two fields together- software development and information technology. Using this approach gets you a fast release. How? Through the use of automation, constant interaction, and a continuous workflow- also known as a DevOps process; a 7-part operation. Plus, efforts are made to get everyone familiar with each step. Not pros, but familiar.

Us? We’re Agile fans.

It’s a win-win. An Agile approach provides better opportunities for both the client and the agency. Deliberately learning from your mistakes allows you to tighten your feedback loop. And when you tighten your feedback loop, you speed up your product. The best part? Because of this to-and-fro cycle, you’re not just getting a flexible product, but a durable one too.

Need help with Agile Software Development? Check out this manifesto.

The internet has evolved from Web2.0 to Web3.0 - and this is not just a change in naming conventions. The underlying technology that powers the internet is changing, with blockchain being one of the key components of Web3.0's infrastructure.

Web3.0: The Next Era of the Internet

The internet has evolved from Web2.0 to Web3.0 - and this is not just a change in naming conventions. The underlying technology that powers the internet is changing, with blockchain being one of the key components of Web3.0's infrastructure. It will be decentralised, secure, self-sovereign, transparent, and scalable - all while being more cost-effective than its predecessor! Read on to find out how blockchain, Crypto and NFTs will be involved in Web 3.0 and what we can expect for the future.

So what are blockchain, crypto, and NFT's then?

Blockchain is a decentralised ledger that records all transactions of crypto - which includes but is not limited to cryptocurrencies like Bitcoin, Ethereum, and Litecoin. Crypto is essentially the fuel for blockchain as it requires an incentivising system for users to contribute their computing power towards maintaining the network (and thus decentralising it). The transaction fee paid in cryptocurrency also ensures security on the blockchain by making attacks costly.

Web technologies are powering Web2.0 with Javascript being one example - think about how many web pages you've seen spammed with ads or pop-ups! But what if there was another way? Well, this will be possible through the utilisation of new technology powered by NFTs, otherwise known as non fungible tokens. These differ from fungible tokens in the sense that one cannot alter the ownership signatures of one token to match another. This makes NFTs unique and thus valuable because they can not be copied or duplicated.

NFTs are being used in the creation of decentralized applications (dapps) which will power Web3.0. All dapps have their own cryptocurrencies powering them, these are known as utility tokens - think about how many times you've seen something advertised with 'Buy Now! Use Cryptocurrency!' The use of crypto techniques like smart contracts is also becoming increasingly popular in order to facilitate decentralised exchanges (DEXes). These enable people to buy/sell tokens without an intermediary; this has led some DEXes to gain huge amounts of volume.

.jpeg)

How does Web3.0 impact our everyday lives?

Firstly, by using a decentralised internet we can ensure that our personal data is not being used to make money from big businesses. We have seen this in recent times with Facebook and Google who have been criticised for collecting data on users without their consent. There are also implications for voting - an area where blockchain has already begun seeing success. In Estonia, anonymous votes were cast using a distributed ledger which ensured transparency - no more elections fraud! The coming years will see many people move towards web browser ‘add-ons’ which enhance privacy & security further while having little impact on performance e.g Brave Browser. Blockchain technology means it's possible to be your own bank i.e control your own funds directly rather than have them held in a regular bank account.

NFTs on the other hand will allow artists, musicians, and even regular users to license their digital assets as they see fit e.g artists can sell licenses for use of a photo - think Spotify but with photos, NFTs & Blockchain technology will allow people to monetise these digital assets and even own them! But how does ownership transfer work, how do we buy and sell NFTs? This is where exchanges come in, think of them as a marketplace for NFTs to be bought and sold. But what happens when you want to buy an item on the exchange? How do we know who owns it or how many tokens exist? This will all be tracked using blockchain technology e.g Cryptokitties uses Ethereum Blockchain.

What can we do to prepare for Web3.0?

We can start using cryptocurrencies like Bitcoin, Ethereum & Litecoin to buy NFTs. We need to be ready for when they become mainstream and want to spend them in the real world e.g paying with cryptokitties at Starbucks! There are already some places that accept these currencies as payment but expect this number to grow exponentially over the next few years (e.g CVS is now accepting it)

There's also a lot we can do on an individual level: I'm currently learning how to code so I will feel more confident about buying/selling items via exchanges or creating my own blockchain / dApp projects etc. If you're unsure of where and how to get started, youtube is always a great place to start - or if you're feeling really brave, buy just 10$ of crypto and have a foot in the game; by being invested, you'll naturally start to search for more info and resources. Get stuck in!

I think one of the most exciting things about Web3.0 is that it could be completely open-source - anyone will be able to contribute ideas or code which could really lead us into a new age of technology! I'm excited already just thinking about what we can do with this!

Cloud computing is continuing to take the digital world by storm. Businesses of all sizes are making the switch to Cloud-based systems, and for good reason.

Cloud computing is continuing to take the digital world by storm. Businesses of all sizes are making the switch to Cloud-based systems, and for good reason. Cloud computing offers a number of benefits, including resource scalability, resilience, and security. In this blog post, we'll take a closer look at why Cloud computing is the future of digital business, and how your business can make the switch, saving your business money.

AWS is the leading provider of Cloud computing services, and for good reason. AWS offers a comprehensive set of tools and services that can be used to build, deploy and scale applications in the Cloud. AWS also offers a variety of pricing options, making it easy to find a plan that fits your budget.

The first stage in the migration process is adoption, but it's also critical to consider how businesses may avoid AWS Cloud costs from escalating uncontrollably. Here are some essential tips on how to enhance your financial efficiency when it comes to the Cloud.

Top Tips for Reducing AWS Cloud Costs:

1. Use Reserved Instances: One of the best ways to reduce your AWS Cloud costs is to use Reserved Instances. With Reserved Instances, you can purchase compute capacity in advance, and save up to 75% on the cost of running those instances.

2. Budget AWS Cloud Services Carefully: Another way to keep AWS Cloud costs under control is to budget for AWS services carefully. When you know how much you need to spend on AWS each month, it’s easier to stay within your budget.

3. Remove Unused Resources: One of the biggest causes of AWS Cloud cost overruns is unused resources. Make sure you delete any resources that your business no longer needs, in order to avoid unnecessary expenses.

4. Identify and Consolidate Idle Resources: AWS Cloud resources may frequently be idle, resulting in unnecessary expenditure. In order to enhance financial efficiency, identify and consolidate inactive resources. The cloud provides autoscaling, load balancing, and on-demand capabilities that allow you to expand your computing power as needed.

5. Lower your data transfer costs: AWS offers a number of ways to lower your data transfer costs. For example, you can use AWS Snowball Edge devices to move large amounts of data into and out of AWS for free.

6. Use the Right AWS Services: Not all AWS services are created equal when it comes to cost. Right-sizing a workload involves re-assessing the true amount of storage and compute power that it needs. To determine this, you need to monitor workload demand over a period of time to determine the average and peak compute resource consumption.

7. Use Spot Instances: AWS also offers a Spot Instance pricing model, which allows you to purchase compute power at a discount. However, there is no guarantee that your desired instance will be available when you need it. Opportunities to buy Spot Instances can also disappear quickly. That means they are best suited for particular computing cases such as batch jobs and jobs that can be terminated quickly.

8. Choose The Right Worker Nodes: AWS offers a variety of worker nodes, each with its own cost. For example, AWS Fargate is a serverless compute engine for containers that removes the need to provision and manage servers. AWS Lambda is another serverless option that is suited for event-driven applications.

9. Use tools for infrastructure cost visualization: AWS provides a number of tools that can help you visualize your AWS infrastructure costs. These tools can help you identify areas where you may be able to save money.

In conclusion, the Cloud is a great way to reduce your business costs and improve financial efficiency. AWS provides a comprehensive set of tools and services that can be used to build, deploy and scale applications in the Cloud. AWS also offers a variety of pricing options, making it easy to find a plan that fits your budget. By following these tips, you can ensure that business is making use of AWS efficiently so that you can focus on what’s important - your business goals.

What are your thoughts on Cloud Computing? Have you already made the switch to AWS? Let us know in the comments below!

When designing new products, it's important to strike the right balance between conducting customer research and starting product development.

When designing new products, it's important to strike the right balance between conducting customer research and starting product development. Spending too little time on research can hamper your ability to discover real customer needs around which to design a successful business. In contrast, spending too much time on research can delay your product development iterations and deprive your team of precious learnings that could be gained from usability testing.

Signs that show you're doing too little research:

There are a few easy sense-checks you can do to determine if investing a few extra days on customer research is worthwhile. If one or more of these symptoms appears, go back through your previous interview notes or maybe schedule a few more customer interviews to drive that last bit of knowledge you need before moving forward. Here are some possible learning gaps that you should think about:

- Not knowing your target clients' journey from beginning to end: The first step in learning about your customer is to appreciate their entire trip. If you're still unsure about all of the stages your consumers should complete, how their feelings vary, who they're interacting with, and what technology they're currently using along the path, keep learning until you've drawn up a clear - and ideally visual - customer journey map. This may assist you in better defining where your solution should fit in the overall process.

- Not knowing how your target consumers are broken down: Personas can assist you in differentiating key aspects among diverse user types. You may better define exactly what target users you want to win by describing their activities, needs, behaviors, and desires. Make sure you make distinctions and similarities between subgroups of customers to properly identify whose needs your product is truly meeting.

- Not having a specific customer's voice in mind: You must capture the experience of a single, identifiable customer who you think epitomizes your target user and use that customer to rally your team. The power of specific user stories is immense and can be highly effective in pitching your venture to others. Building a new venture is tricky because the path is full of distractions and possibilities. The voice of the consumer can be your compass. Revisit your research until you’re able to pull out enough customer verbatims to ensure user-centricity among your team.

- Not knowing how customers would characterize and describe the problem: Consumers tend to have different mental models and concepts that they use to explain the same problem. To ensure that you optimize all your copy and marketing for customer conversions, you must speak consumers’ language. So avoid using jargon and complex constructions. Use consumers' own words wherever possible.

- Not understanding how your consumers view your competition: Before you design and build anything for your audience, there’s so much you can learn from what they think about products that already exist in the marketplace. So make sure you’ve had ample opportunity to ask consumers about what products they’ve seen, heard of, or used before - the competitors playing in the same arena. Ask consumers for their thoughts about those solutions - and why they did or did not enjoy using them. If they’ve never tried those products before, why not? What would change their mind about a product?

- Not being clear on how the problem you're solving compares to other pain areas in your customers' lives: It’s crucial that you grasp how the pain point you’re focusing on solving stacks up against your audience’s other relevant circumstances and issues. Do they care enough about this pain point to give you the time and money to solve it? Or is there a more important problem on which you could and should be focusing?

Signs that show you're doing too much research:

The more you research and learn about your customer base, the better it is said to help product design. However, in reality, spending too much time on customer research may lead to significant problems for your business. Delaying product-development timelines, allowing your competitors to gain a lead, losing focus, and becoming trapped in analysis paralysis are all possible consequences. The following are indications that you're ready to advance to the next stage of product development:

- Getting too caught up in user personas and customer journeys: the purpose of research is to advance clarity, not cause confusion. If you’re finding yourself knee-deep in data, trying to account for every permutation of your personas and their nuanced journeys, it’s time to stop and simplify. Your goal should be to capture just the right amount of complexity, so keep your personas simple and avoid getting too creative with your customer journeys. Generalize where possible and try to create models that your team can easily reference - models that can guide you onward.

- Hearing the same feedback continuously: If you're getting the same inputs from different, unconnected consumers over and over again, you've already found a pattern. It's probably time to move on if the next few customer conversations produce little new information.

- Taking too long to prototype: It is hard to put time limits on when you should move on to such work - mainly because the right answer depends on how much day-to-day capacity you have for pushing your ideas forward. Maybe you’re exploring ideas in your free time outside of work. But, if you’re working on your product full time, months have already passed, and you haven’t yet gotten around to building it, you should probably reevaluate your progress. Explore some ways to move forward with prototyping and testing your learnings and assumptions so far.

When prototyping and testing, you would be better off going for quick sprints that target particular assumptions or problems. Avoid getting stuck in analysis paralysis. Remember, customer research is a means to an end: building a minimum viable product (MVP) that you can test. It’s okay if you don’t know or fully understand everything about your customer base. In fact, your learning only deepens once you have something you can put in front of your customers.

In conclusion, customer identification should be as fine-grained as possible. Identify the various sorts of consumers that may be in a product category and what their pathways might look like. Understanding customers' decisions, inquiries, and low points allow you to make better judgments about who to develop your product or service for and what issues you want to address during their journeys. You should begin by striving for complexity so that you may notice little details.

However, you should then attempt to generalize until you can make broad-based decisions. There is no such thing as a single client journey, not even for one persona. Your goal should be to gather enough information to determine what critical, important learnings are required in order for you to establish a functioning model that allows you to take action.

There is a sweet spot for research in customer-insight development that balances complexity with simplicity. Being conscious of how much time and effort you should devote to research might help you achieve this objective and, as a result, produce better goods faster.

The pandemic has significantly accelerated the move to digital, forcing certain businesses to adjust. At the same time, buyers still want businesses to be simple to order from, engage with, and get service from.

The pandemic has significantly accelerated the move to digital, forcing certain businesses to adjust. At the same time, buyers still want businesses to be simple to order from, engage with, and get service from.

What is the difference between an exceptional customer experience and a good one? What are the steps you can take to ensure you provide your customers with both an excellent and pleasant encounter? Customer Experience (CX) needs redefining to be seen as more than simply a business practice. And in order to do so, businesses must change their perspective on CX through a comprehensive customer relationship management (CRM) strategy integrated into a modern CMS platform, with buy-in from all team members.

How have customer expectations changed, and which of these new behaviors are likely to endure?

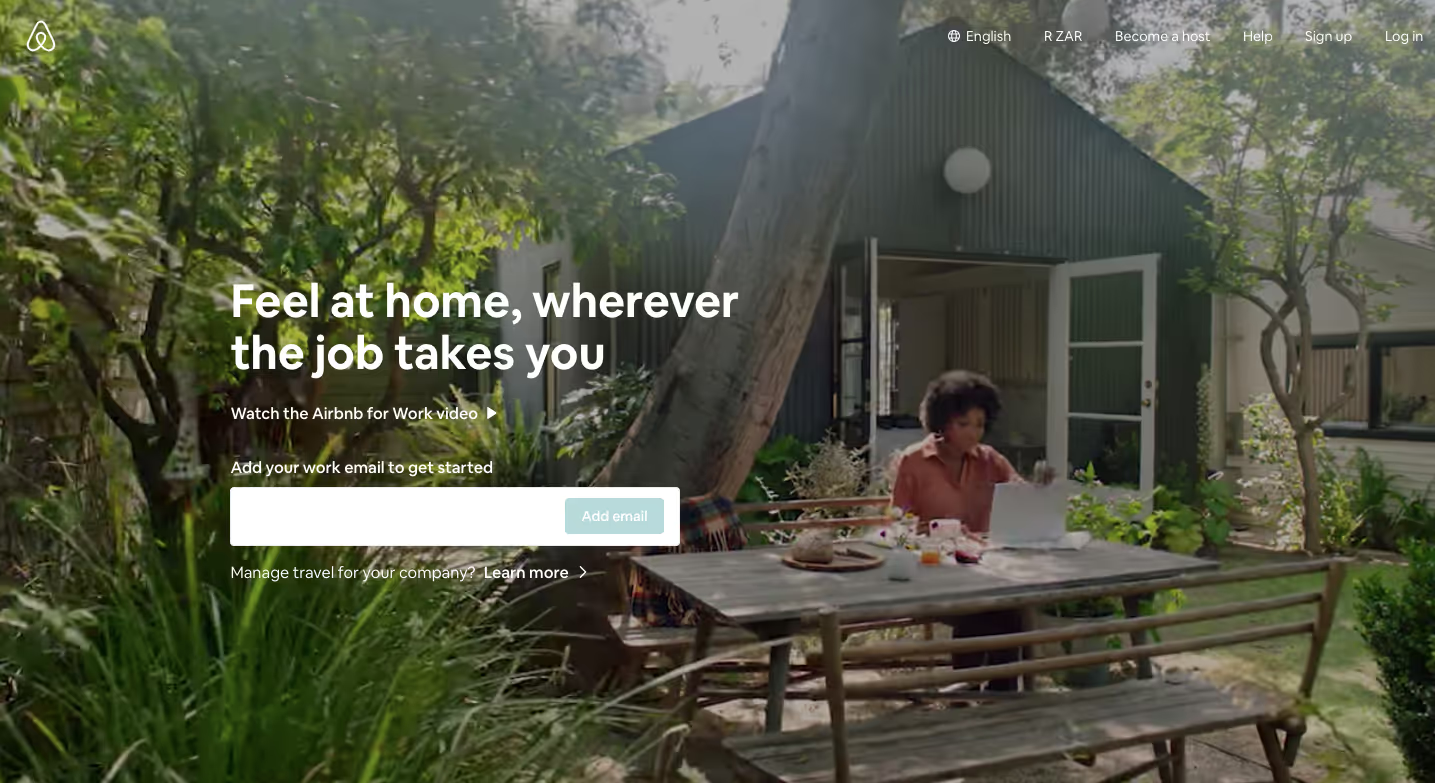

Customers are curious as to why a business that provided a fantastic digital experience during the lockdown would not be able to maintain it in a post-pandemic world.

For today's customers, being happy is no longer an added value to their experience; it's the fundamental foundation on which your connection is founded. Consumers will pay more attention to a moment of friction than to a moment of flawless performance. Buyers are now more independent, expecting more intuitive experiences, and are stronger in their ability to change service if the experience does not fulfill their expectations.

Only those businesses that recognize their customers' requirements, wants and most importantly needs, focus on them first, and provide seamless, contextual experiences across all touch points will survive in today's extremely competitive market.

What's the best way for a business to offer a seamless customer experience in 2022?

It's critical to unify marketing, sales, and customer service under one department, then create a decision-making group that owns the end-to-end client experience and has a winning aspiration centered on consumers rather than functions. This will allow any business to operate quicker while staying focused on its customers.

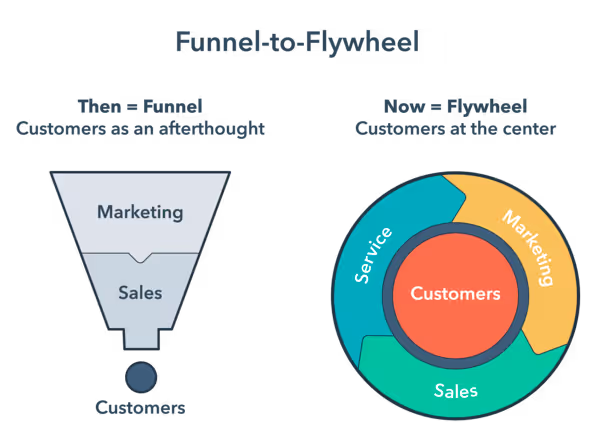

The funnel approach has previously dominated CX. Different functions focus only on fulfilling their part of the funnel before passing the customer on to be someone else’s problem once the sale is made. Instead, making use of an approach that puts the customer at the heart of a continuous process to attract, engage and delight customers will result in all functions having an ongoing responsibility to support one another in fulfilling goals for the overall business.

What is the role of technology and what obstacles should businesses overcome?

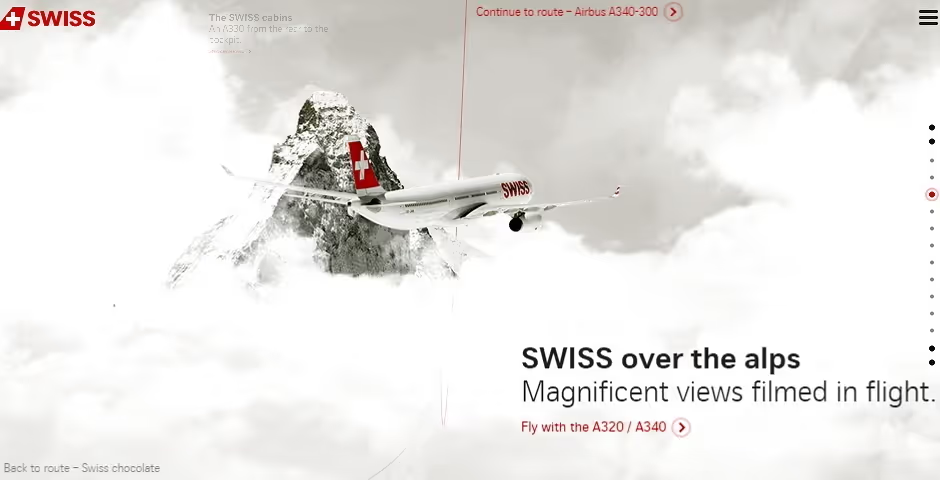

The 2020 survival mentality resulted in procedures and operations that were ill-suited for scale. As CX has become more complicated, most businesses have employed a patchwork of disparate technologies from various vendors, each with its own distinct underlying technology stack: a CRM to handle consumer data, a customer management system (CMS) to develop their website, and marketing automation to increase their activity.

When two completely distinct platforms are assembled together, the burden of employing them successfully is placed on the customer. This method is preventing businesses from flourishing, slowing them down, and depriving them of a complete perspective on their clients. It's also difficult to reconcile these differences without generating friction for customers.

Today's businesses need a strong and easy-to-use CRM solution that enables them to establish a "single point of consumer truth" that customer-facing staff can consume, allowing them to eliminate friction in client interactions and deliver delightful digital experiences in 2022.

Where should businesses be concentrating their resources?

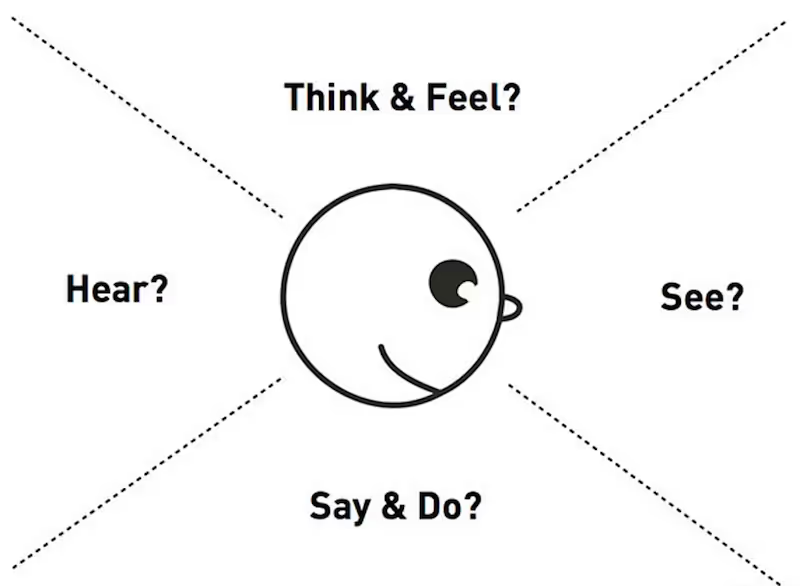

To get the digital experience right, good data is required: dependable, organized, and actionable data with insights into each customer's experience. ‘Who are your customers?’ isn't a useful question anymore. Instead, you need to be able to see the whole picture of this and other individuals in order for it to make sense. What does a customer's digital path look like? When, where, and how have they engaged with your business? What do they require and desire from you now, as well as what will they anticipate from you in the future?

It's also critical to guarantee that businesses provide all parts of the digital journey online. We've seen greater website traffic than ever before since the epidemic, and consumers will expect the same accessibility and convenience that they have come to expect from businesses over the last year.

Today, connecting what's going on on your website, the front door of your business, to the rest of the customer experience is a must. This may be a significant issue for businesses that don't use CRM systems. There will be businesses who have reached the maximum capacity of their present set-up and believe they are stuck. It's time for businesses to consider CMS as part of CRM in light of how closely linked customer experience is to websites today. The bar for customer experience has been raised; similarly, yours should be too.

It’s no secret that we all need to do our bit in reducing our energy consumption if we want to protect our planet, but the concept of "energy saving" is rather abstract.

It’s no secret that we all need to do our bit in reducing our energy consumption if we want to protect our planet, but the concept of "energy saving" is rather abstract. Knowing your exact carbon footprint and then tracking how much energy you have saved can give you a better idea of your contribution to a greener environment.

This is true for our personal lives, as well as business, and technology developments overlap in both. As the tech industry continues to develop and grow, so too, does this development impact our environment. The importance of energy-efficiency in all aspects of life is paramount, but how does this translate to mobile application development? What is best practice to paint your mobile app “green”, so-to-speak? Blott Studio along with Zevero, one of our clients for whom we have built a carbon footprinting management tool, takes a closer look.

Whilst software development isn’t the first thing that comes to mind when talking about carbon-intensive business operations, it is indeed responsible for a considerable amount of carbon emissions and it is therefore worth considering building a strategy to reduce those emissions. These emissions are attributed to building the operational app through its cloud providers (measured as emissions per gigabyte stored).

However, Zevero noted that the small amount of emissions produced through the creation of their platform was completely overshadowed by the tens of thousands of emissions their platform currently manages and the opportunities they have to scale reductions across entire industries. This is the impact of developing one “green” application.

With this in mind we have identified eight ways in which ourselves, and you, can reduce the carbon footprint associated with the development of applications:

One: Choosing the right hosting partner

By the year 2025 it is believed that data centres will account for 3.2% of all global carbon emissions (this is more than all airline emissions combined). It is therefore important to choose an eco-friendly hosting provider; one that makes use of renewable energy sources and/or has efficient data centres. A wide network of hosting partners is available for hosting services, so selecting a green partner is a great way to receive the technical support your application deserves, while still accounting for energy efficiency.

Two: Implement an efficient cache policy

It’s no stretch of the imagination to make the connection that caches use a lot of data, and thus a lot of energy resources. There are two ways to optimise your cache policy to ensure it operates efficiently. First, add support to all apps and APIs of If-Modified-Since header field with HTTP 304 Not Modified. Second, compress the data by making use of content delivery network services (CDN services). The new rule ensures that data will not be sent unnecessarily, while data compression reduces data usage.

Three: Optimise all support media

Re-evaluate all of your app’s resources to further minimise your carbon footprint. Start by clearing out unused metadata, media and images. Next, ensure all existing media and images are in vector or jpeg form. Alternatively, if media elements are non-vector, resize all items to the minimum-recommended size. Making these changes will get rid of excess weight and ensure that download times are optimised.

Four: Reduce data transferal

This tip is two-fold as it not only aids in your mission to reduce the carbon emissions of your application, but also improves the overall UX of your app by improving speed and reactivity. As previously mentioned, data is energy-intensive, so it is imperative to find ways to minimise data usage without compromising on UX. “Lazy loading” is the action of prioritising resources so that only those that are needed are downloaded for any given scenario.

Five: Declutter your app

Now, we’ve addressed the back-end by way of decluttering your app, but what about the front-end? Every feature added to an application adds more weight and increases the carbon emissions of the app. As per a report conducted by Standish Group, 45% of app features are used very little or not at all. Take the time to evaluate which features aren’t being used and remove them. The general rule of thumb is to reconsider keeping all features that are used by less than 5% of your users.

Six: Enforce energy efficiency

Mobile apps are known to drain a device’s battery, but these energy-intensive tools are also a burden on our carbon footprint. A good policy to implement is adapting the app’s behaviour based on the device’s power mode; effectively limiting background activity when the app is in low power mode. Examples of “background activity” could include location updates, Bluetooth and audio, amongst others. Battery life, speed, responsiveness and an “element of cool” all contribute to a great UX, as per the iOS App Energy Efficiency Guide, so your users will be sure to thank you for heeding this advice!

Seven: Optimise the use of location services

This rule is simple: don’t make use of location services when you don’t need them; location updates should only occur when absolutely necessary. It is completely understandable that developers require location information from time-to-time and to a certain degree of accuracy, but keep in mind that the more often this information is requested, and the more accurate the readings need to be, the higher the impact on your carbon emissions. Consider how regularly you truly require this information and to what degree of accuracy (will national rather than local suffice for your needs?).

Eight: Optimise the use of timers and notifications

Timers that run in the background and notifications that wake a device are all energy-intensive. Timers that are abandoned but not disabled further impact on energy usage. Consider if timers are the best solution for your mobile app, or if something like an application programming interface could work better. Our recommendation, on the topic of push notifications, is to make use of local and remote notifications. Local notifications are great for time-specific requirements, while the deferred delivery method for remote notifications ensures that the notifications are sent at a time that is most energy-efficient.

Our belief is that all mobile app developers should aim to produce green applications to the best degree possible. We’ve highlighted our guide to creating better-for-the-environment platforms that will not only help you to reduce your carbon footprint but optimise the UX at the same time. Selecting the right partners, implementing a few changes to the operational side of things and looking at simpler, cleaner displays all play a major role in mitigating the effects of carbon emissions on the planet. Blott Studio invites you to paint your mobile apps “green”!

Reach out to the Blott Studio team to further discuss best practices regarding energy-efficient mobile app development or find out how we can implement our tips throughout the design process of your mobile application.

The IT industry is surging as the innovation of technology continues to reach new heights.

The IT industry is surging as the innovation of technology continues to reach new heights. While this is great for those of us eager to download the latest app or communicate with our home appliances, the short straw in this industry boom is the lack of web developers looking for work. U.S. Labor Statistics found that, in December 2020, there was a shortfall in developers worldwide amassing 40 million roles and, worse than that, their forecast is set to reach double that number by the year 2030. Many companies are thus facing a similar conundrum: how to recruit a programmer.

The problem is that, in many cases, recruiters are bombarded with applications, only to find that many are underqualified. As a result of this, our instinct is to default to bias. Filtering applications according to schooling is a typical way we sift through CVs, but could we be overlooking quality programmers by doing this? How do you suss out the best talent and secure a candidate for your programming role? The answer lies in both the functional fit, or technical skills, as well as the cultural fit, or soft skills, of your candidates.

Functional Fit